Articles in this blog post:

Articles in this blog post:Question: What are some current events in your industry (media)? What was the impact of these events in the industry?

Article Summary: Last Thursday on September 15, 2011, Netflix, one of the giants of the media industry, had its shares fall by 19 percent. This came from a the attempt to implement a new policy focusing mainly on streaming entertainment to viewers while trying to cut down on the usage of DVDs. While users could formerly get unlimited streaming and DVD rentals for approximately $10 a month, now the bundle has been split, with each of the options costing around $8 monthly, meaning that those who want both DVDs and streaming have to pay $6 more.

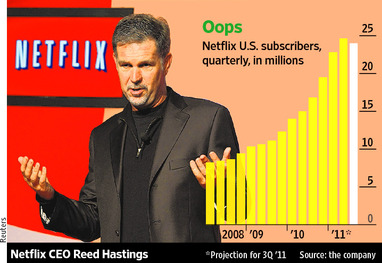

This drastic change did not get good reception, as along with dropping in stock the company also expects to lose 1 million customers, mostly in DVD subscriptions. However, while dealing with some large numbers, this is a fairly small setback for the company: it is still projected to have a total of around 24 million subscribers by the end of the quarter, with an estimated 12 million staying in both plans and paying the extra 6 dollars. However, Netflix should still be wary, as some companies like Comcast are using this moment of weakness to demand a higher payment since a large percentage of the viewers watch their shows. Additionally, Netflix is expected to take another hit when the Starz content, including several Disney and Sony movies and shows, expires and is removed from the site, as Starz has refused to renew their deal unless they get paid more for licensing fees.

My opinions: Overall, I would say that Netflix's action to change prices to encourage more streaming and less DVDs was worth the price. While 1 million of their customers have stopped their subscriptions, they still are expected to have 24 million, with the possibility of many more joining due to Netflix's consistently strong growth each quarter. Additionally, via some rough calculations, Netflix earns more revenue with the new prices than with the old. To wit:

With 25 million customers, assuming EACH one has the old unlimited streaming and DVDs price of $10 a month, Netflix had a revenue of $250 million each month.

With 24 million customers, 12 million of which still have the unlimited streaming and DVDs plan at $16 now and the remaining having EITHER unlimited streaming OR DVDs at $8 a month, Netflix has an estimated revenue of $264 million each month.

These are rough calculations, but even if you assume that every customer had the old unlimited plan, Netflix still makes more revenue now than it did in the past. However, this relies on the assumption that Netflix's numbers will remain fairly constant or increase. If more customers switch to only streaming or if Netflix loses significantly more customers than their end of quarter prediction expects, revenue will decrease. Thus, this action, while bringing some shock and loss in stock prices in the short term, benefits Netflix by brining in more revenue, which in turn lets the company get more shows and movies for the website and thus enhance the consumer's value. Additionally, since DVDs are more expensive than streaming since they require the purchase of physical discs instead of bits of data which can be copied and sent across the world easier, even if Netflix does end up losing revenue it would still increase profit by reducing the number of DVDs.

All things considered, while Netflix is suffering from a setback currently, the company has consistently been increasing in value and revenue since 2008, as seen in the attached image, and I believe that their role in the media industry will still stand strong.

The issue of Netflix currently seems to be the most controversial issue in the media industry, which seems somewhat silly considering that its really just a matter of a not unreasonable change in price in order to facilitate a transition of a company further into the digital age.

ReplyDeleteI agree with you that Netflix's decision wasn't a bad one. However, I think it should have been handled a bit more smoothly so as not to alienate as many consumers. As opposed to focusing so much on forcing the DVD side of the business to wither away, I think they should have focused more on expanding streaming which at the moment doesn't offer enough variety. All in all, however, I think Netflix will get through this time with minimal losses.

I agree with Anna; Netflix had a tough decision to make, and their pricing change was probably the best they could do. Netflix subscribers are probably going to end up coughing up the extra money because they realize how much they relied on Netflix to get their movies--both online and on DVD. Additionally, customers who perhaps felt that $10 was too much may be willing to pay $8 instead even though they'd only get the advantage of only online streaming or only DVD movies.

ReplyDelete